For first time buyer Jack Harrold, the low point was when he woke up at 6am to open an email from his solicitor that had been sent two hours earlier. It told him that the plan to complete on his one bedroom purchase in Harringay by early March was unrealistic; it was more likely to be May before the deal got over the line.

For the 28 year actor, stepping on to the property ladder with his partner for the first time, it was the worst possible news, “a really rubbish way to start the day.”. Not only would they miss the completion date deadline to qualify for a discount on their stamp duty bill, but also probably have to pay for a short-term rental, storage costs and two sets of moving fees.

The extra stamp duty alone is an extra £11,250, and with the other costs, the bill could reach £15,000. It is money they do not have and will mean either agreeing a price reduction with the vendor or pull out of their £510,000 transaction. ”It’s all been bloody stressful,” says Jack with understandable feeling.

He is not alone. Jack’s predicament is a situation painfully familiar to thousands of increasingly anxious property debutants all over London as they enter the last weeks before the stamp duty drawbridge is raised. For the first time buyer property market we are now in, to quote former Manchester United football manager Sir Alex Ferguson, “squeaky bum time.”.

Goodness knows buying your first property is a stressful enough experience at the best of times. But London property newbies are facing the added pressure of a hard deadline that they know will cost them up to £11,250 if they fail to hit it. On 31 March generous stamp duty discounts for first time buyers introduced by then Chancellor Philip Hammond in November 2017 to help thousands of young people gain a foothold on the property ladder will come to an end. And the implications for the London market are profound.

Any deals that do not complete by midnight that day and fall over into April will be hit by far higher tax rates. For the last eight years bona fide first time buyers have paid no stamp duty at all on any properties priced at less than £425,000. It has been a godsend.

Even in the stratospheric London market there are still a good number of “first rung on the ladder” properties priced below that threshold. Property portal Rightmove currently list 12,198 flats, and a few houses, at sub £425,000. For the next £200,000 buyers currently pay a 5% stamp duty rate, up to a ceiling of £625,000 at which point all the discounts fall away. That means the stamp duty bill on a typical £500,000 London property completing today is a relatively modest £3,750 for first timers.

But from All Fool’s Day everything changes, following a decision by Rachel Reeves announced in the October Budget. Then the old bands return and stamp duty bills start to look a lot more intimidating. Stamp duty will only be only waived on properties priced at below £300,000, a rarity in London.

From £300,000 to £500,000 the 5% stamp duty rate applies. But above £500,000 there will be nothing to benefit first time buyers at all. And it is at this sort of level – fairly typical for London property virgins – where the penalty starts to get really tough.

For first timers paying £400,000 the stamp duty bill increases from zero to £5,000. But the really eye-watering increases are above £500,000 beyond which point the penalty for slipping past March goes up to £11,250. No wonder they call April the cruellest month.

So for a first time buyer paying £600,000 the stamp duty bill for a purchase completed on 31 March is £8,750. In very next day the new owner have to pay £20,000. Ouch. The reforms are not specifically targeted at the capital, but as ever, it is poor old London that suffers most because of the way the bands are structured.

The result has been a stampede of buyers since October. Leading high street mortgage lender Santander said it saw mortgage applications shoot up 130% in the last three months of 2024 after Rachel Reeves fired the gun on the countdown. Graham Sellar, head of Santander’s intermediary channel, recalls that towards the end of a previous stamp duty holiday during the pandemic, the Government pushed the deadline from the end of March to the end of June, and to September for first timers, to give them time to get their deals over the line.

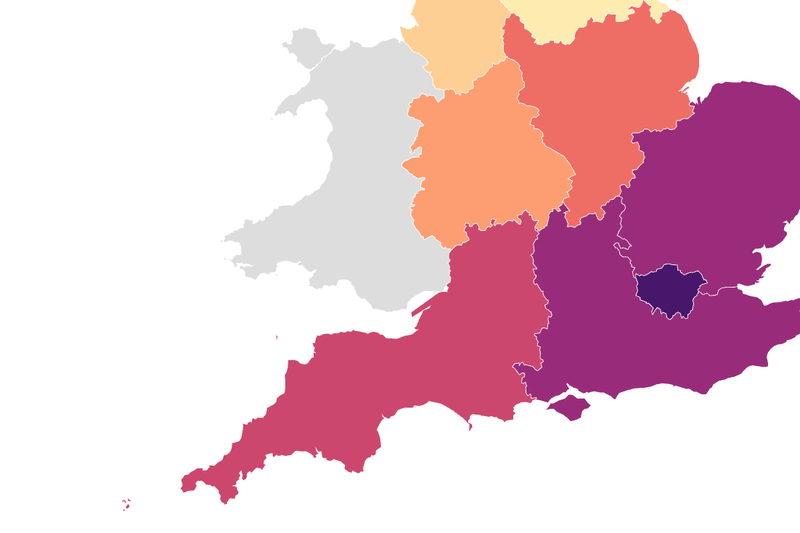

“This time there is no hint of a concession,” he said ominously. And according to research by advisers Alexander Hall, it is not the wealthiest buyers doing their property shopping in Kensington or Westminster who will be worst affected, as they never benefitted from the relief anyway.

No it is the next tier down, professionals stretching themselves to the max to buy in areas such as Haringey, Hackney, Richmond upon Thames and Wandsworth, where first time homes average between £500,000 and £600,000, who will suffer the most painful hit.

And those lost reductions on the stamp duty bill really matter. Chris Sykes, technical director of brokers Private Finance, points out that £11,250 “is potentially another year, or even a couple of years, of savings, or it could mean that instead of a 10% deposit you only have 8%. And that puts you in a higher band for mortgage interest rates and could cost you thousands over the years.”.