Simon Gerrard, chairman of Martyn Gerrard estate agents, said: “These upcoming stamp duty changes will disproportionately affect first-time buyers in London, where housing is much more expensive, with 97% of sales set to pay stamp duty from April.

He added: “It’s positive that most first-time buyers will still pay no stamp duty from April, but these changes hit those buying over £300,000 in southern England the most, where buying costs are already high.

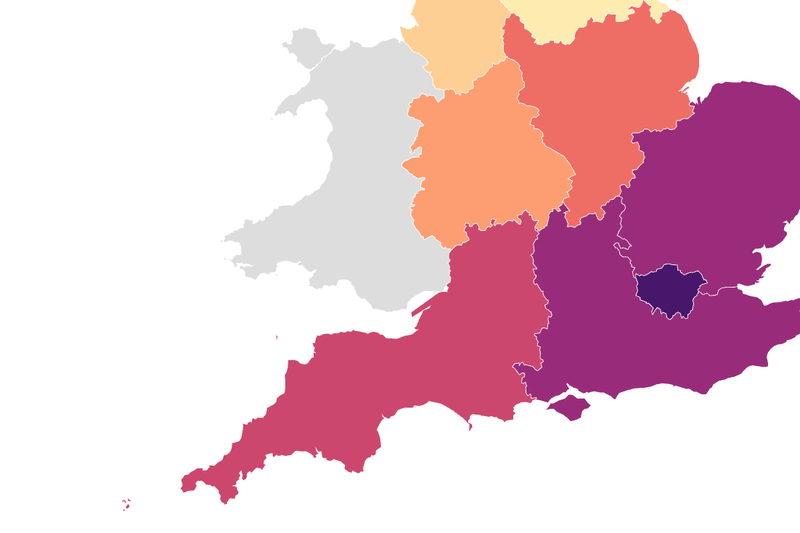

Here are the percentages of transactions where existing homeowners buying a property as their main residence are liable to pay stamp duty now, followed by the estimates from April, according to Zoopla:.

The proportion of first-time buyers in England and Northern Ireland who will need to pay stamp duty will double from April, according to analysis by a property website.

Meanwhile the proportion of existing homeowners buying a new home as their main residence who will be liable to pay stamp duty will increase from 49% to 83%, according to Zoopla’s calculations.

.jpeg?crop=8:5,smart&quality=75&auto=webp&width=960)