Over half of APP scams last year ‘carried out by fraudsters using social media’

Share:

Authorised push payment (APP) scams cost UK consumers £341 million last year, with social media platforms used by fraudsters to carry out more than half of the volume of incidents, according to figures from a regulator. APP scams happen when someone is tricked into transferring money to a fraudster.

The Payment Systems Regulator (PSR) said that in 2023, social media, messaging and call platforms were targeted by criminals to carry out 56% of APP scams (124,057 incidents), accounting for around one fifth of the value lost (£67,429,184). Auction – or purchase – and listing platforms were targeted by fraudsters to carry out incidents accounting for 6% of the total loss value.

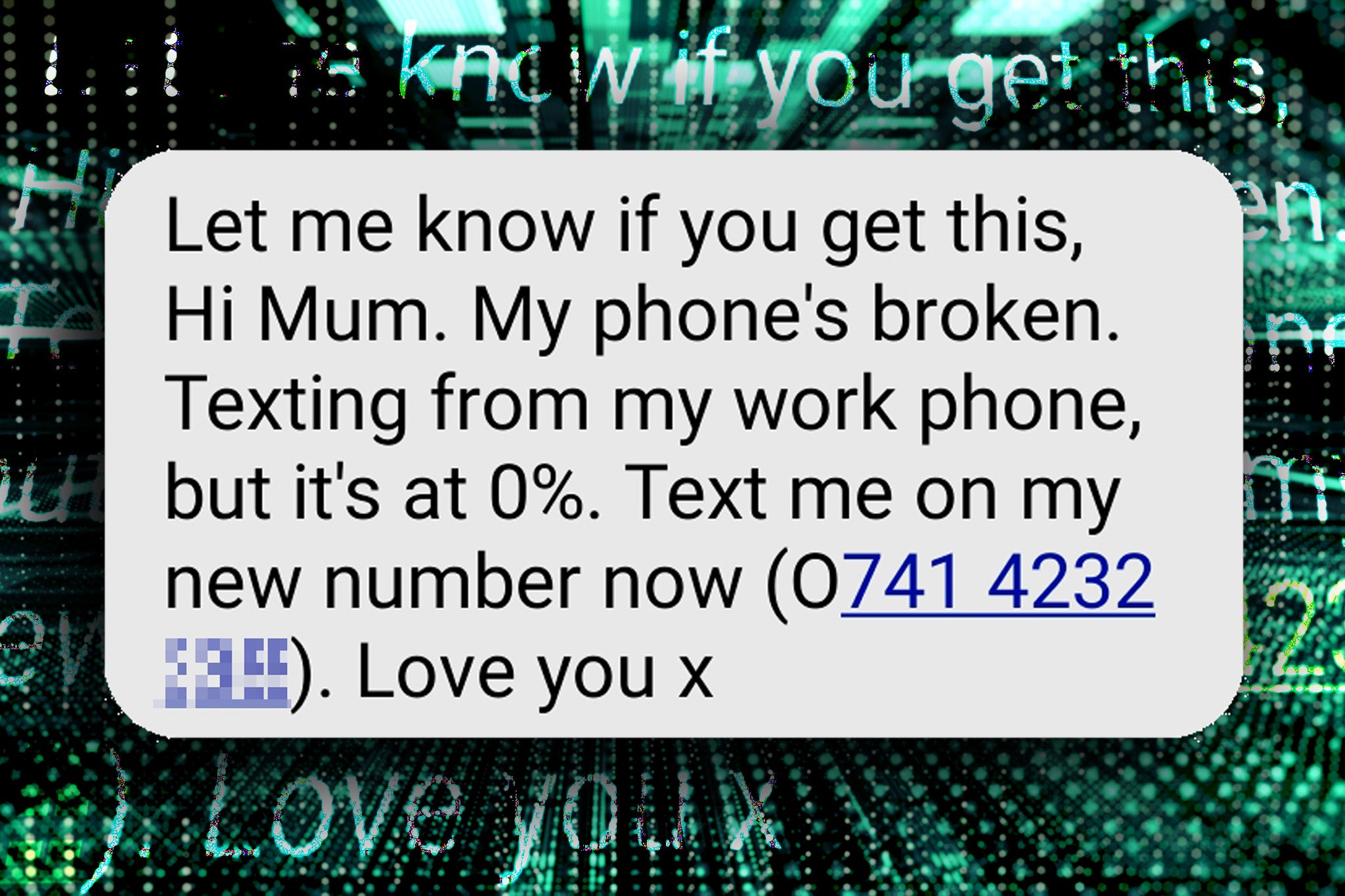

Telecommunications platforms were used to carry out a significant amount of APP scams via fraudulent calls and text messages, with fraudsters using these methods accounting for 31% of the value lost, at £107.2 million. Email providers were also targeted by fraudsters to carry out 10% of losses by value, at £35 million, although these only accounted for 2% of the volume of incidents.

In October 2024, the PSR introduced mandatory fraud reimbursement rules for banks. Previously, many banks had signed up to a voluntary reimbursement code. Kate Fitzgerald, the PSR’s head of policy, said: “Our report highlights how major platforms are being exploited by fraudsters to deceive victims, often with devastating effects….