Profits hit as total held back for payouts rises to almost £1.2bn amid uncertainty over final financial impact. Lloyds Banking Group has been forced to put aside a further £700m for potential compensation over the ballooning car loan commission scandal, in a move that knocked its annual profits by 20%.

The latest provision marks a notable jump in the bank’s estimates for the potential cost of the scandal and brings the sum it will hold back for payouts to almost £1.2bn. RBC Capital has estimated the bank could ultimately be on the hook for up to £4.6bn.

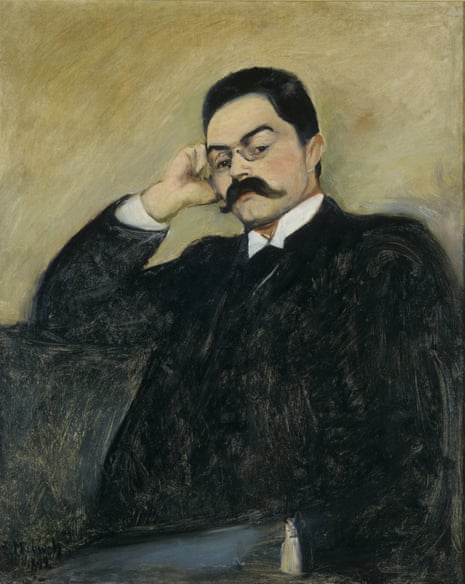

“Clearly, significant uncertainty remains around the final financial impact,” the Lloyds chief executive, Charlie Nunn, said. The extra reserves weighed on the bank’s annual performance, pushing its pre-tax profits for the 12 months to December down 20% to just under £6bn, compared with £7.5bn last year.

Lenders have been grappling with the fallout of a shock court judgment in October that vastly expanded a Financial Conduct Authority investigation into motor finance commissions and sent compensation estimates soaring. The landmark ruling determined that paying a “secret” commission to car dealers who had arranged the loans without disclosing the sum and terms of that commission to borrowers was unlawful.

Analysts at HSBC estimate that the collective bill for lenders could rival the payment protection insurance saga and reach more than £44bn. However, two specialist lenders, Close Brothers and FirstRand, hope to overturn the ruling at a supreme court hearing, due to be heard from 1-3 April.

While Lloyds is not a party to the court case, it has the biggest exposure to car loans among the UK’s high street banks, and its share price has been roiled as investors have digested developments in the case. Lloyds put aside £450m in February last year, months before the court of appeal judgment. Nunn said on Thursday that he and colleagues at Lloyds “welcome the expedited supreme court hearing at the beginning of April”.

Sign up to Business Today. Get set for the working day – we'll point you to all the business news and analysis you need every morning. after newsletter promotion. Nunn and fellow bank bosses had been hopeful that their payouts might be curbed after the chancellor, Rachel Reeves, controversially applied to intervene in the supreme court hearing last month. That application urged judges to avoid handing “windfall” compensation to borrowers harmed by allegedly secret commission payouts.