ANALYSIS: Trump promised no taxes on tips, Social Security or overtime. Eric Garcia writes that the math does not add up. On Tuesday, thanks to aggressive lobbying, Donald Trump and House Speaker Mike Johnson got a win when they passed a budget resolution to begin the process of passing “one big, beautiful bill,” to accomplish the president’s domestic policy agenda.

![[Senate Majority John Thune now has to grapple with including as many of Trump’s campaign promises and making the president’s tax cuts permanent]](https://static.independent.co.uk/2025/02/21/15/EEUU-PRESUPUESTO-CONGRESO_07375.jpg)

Already there are cracks between the House and the Senate. The Senate preferred to pass two bills, with the first focusing on beefing up spending for the border, energy exploration and the military while the second bill would focus on extending the Trump tax cuts.

Democrats have zeroed in on the potential cuts to Medicaid, the health care program for people on low incomes, people with disabilities and children. But there’s another part that could trip up the Republicans: how to reconcile their plan to extend the Trump tax cuts with Trump’s grab bag of campaign promises to eliminate various taxes.

On the campaign trail, Trump proposed eliminating taxation on tips – which Kamala Harris later copied in a bid to win over union workers in Nevada – Social Security, and on overtime. Rep. Lauren Boebert was mocked on X when she touted that “No Tax On Tips has passed the House!” when in fact, this was just the outline to begin writing the bill.

On top of that, Trump suggested a reversal of a key part of the 2017 tax law. That law put in place a cap of $10,000 on how much people could write off their state and local taxes (SALT) as a deduction on their federal taxes. Democrats have used to hammer swing-district Republicans in blue states where state and local income taxes tend to be higher.

That’s a big ask, which already has some Republicans nervous. “I still think we'll have to come back and take another bite at the apple, regardless what's done in this big, beautiful bill, I think there'll be pieces left for us to come pick up later,” Sen. Roger Marshall of Kansas, a major supporter of the president, told The Independent.

Sen. Jim Justice of West Virginia defaulted to the classic kind of magic math that Republicans have used to justify sweeping tax cuts for the past few decades: that the tax cuts will unleash economic growth that will make up the difference lost by a decrease in money sent to the federal government.

“I think those are absolutely major impacts to the upside of the economy, and there are multiplier effects that will absolutely fuel the economy and get us really cooking,” he told The Independent. But there simply is not enough money in the budget resolution to include all of these promises without exploding the deficit. The House bill ostensibly allows for $4.5 trillion in tax cuts throughout the next decade, while requiring spending cuts across the various jurisidictions of $1.5 trillion.

In addition, Republicans included a provision which requires that if Republicans fail to find $2 trillion worth of savings, the amount of money for tax cuts reduces by the difference between $2 trillion and the final number of savings, giving them even less wiggle room for tax cuts.

The House tends to have far more fiscal hawks than the Senate, although it should go without saying that $4.5 trillion worth of tax cuts is far less than $2 trillion worth of savings and would bust the budget even more than Trump did in his first term.

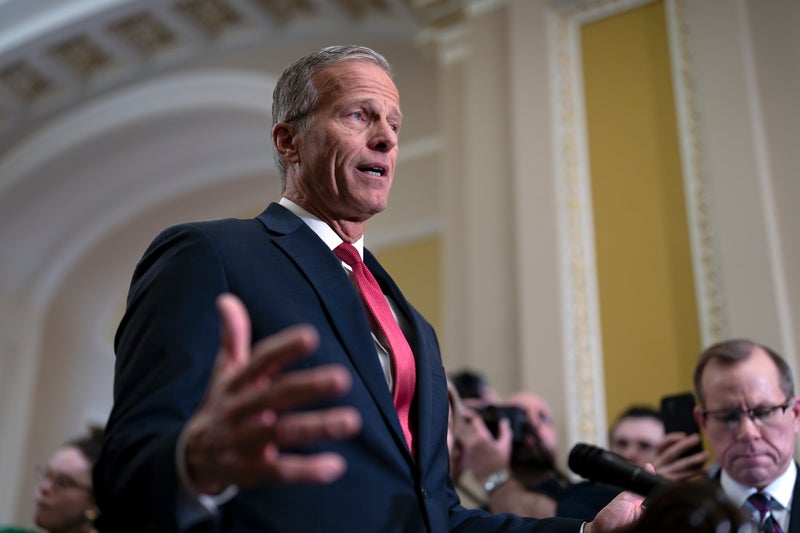

In short, Republicans find themselves in a taxation pickle. “I don’t know yet,” Sen. John Kennedy of Louisiana told The Independent about how Republicans fit in all of Trump’s campaign promises. This also presents a problem for Senate Majority Leader John Thune, who took up the mantle from Mitch McConnell as the top Republican. Thune has to balance between Trump’s demands and what his senators want to include in the bill, which creates a conundrum.

“We want to help the president deliver on his agenda, and we're looking at all of the proposals that are out there that were made by the president and some of our colleagues,” he told The Independent. “We have a lot of our colleagues who've made suggestions about provisions they'd like to have, tax policy that they’d like to have included in there, and, and they're all good ideas.”.

But the math simply isn’t there to include everything. And the job of the majority leader – particularly in the more measured Senate compared to the chaotic House of Representatives – is to prioritize what goes into the bill and tell the president what is possible with only 53 votes in the Senate and an even slimmer majority in the House.