‘A vicious circle’: how the roof blew off Spain’s housing crisis

Share:

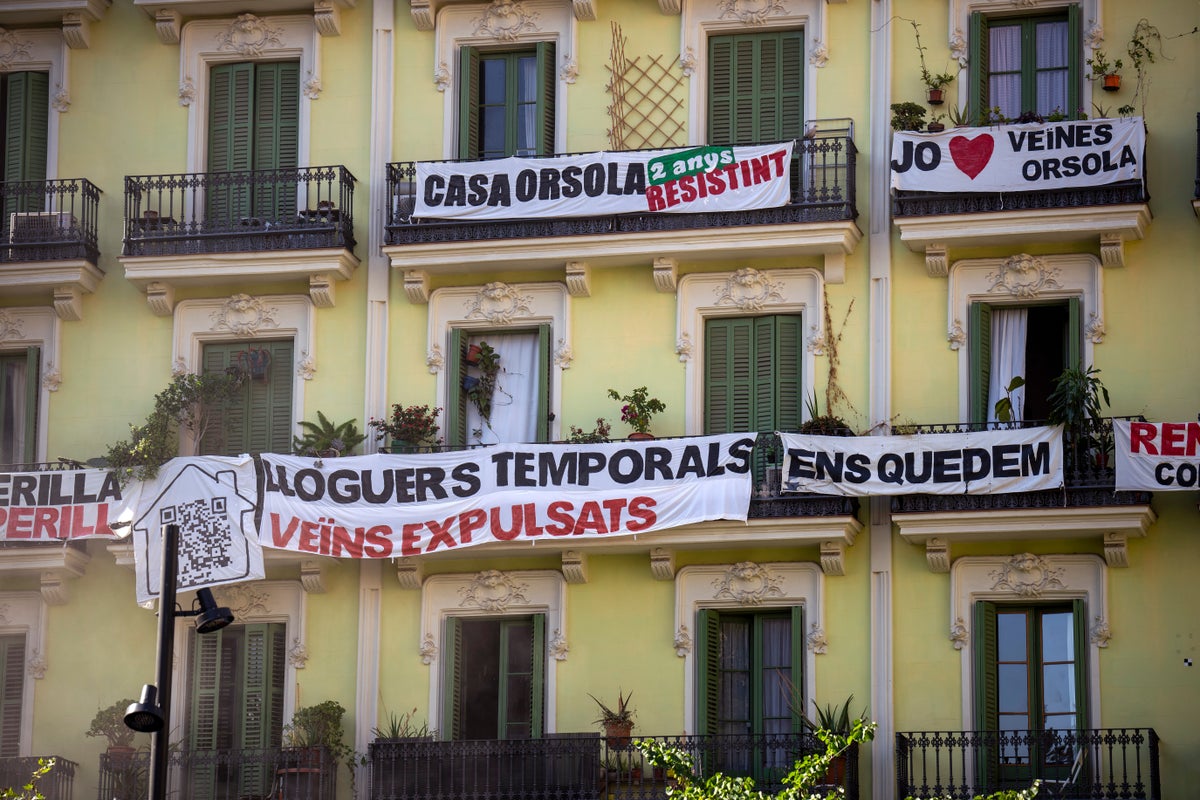

Rents spiral and neighbourhoods lose charm as cities report tourist flat boom and surge in housing speculation. Ciutat Vella, the old city of Barcelona, was once quirky and mysterious. Now it has become a parody of itself, a place from which the local population has been exiled in the interests of tourism and maturing investments. Doorways have sprouted combination key safes, a telltale sign of an apartment given over to tourist lets. A 100-year-old apothecary and shirtmaker that stood on La Rambla for two centuries have been replaced by shops selling flamenco dolls and ceramic bulls.

![[A view over the rooftops of the old city]](https://i.guim.co.uk/img/media/ece83df3f3536d1d72642ed8f4ecdf8fbf68c885/500_0_5000_3000/master/5000.jpg?width=445&dpr=1&s=none&crop=none)

Cities across Spain tell a similar story of slow transformation at the hands of property speculation and a boom in tourist flats – of high rents driving out residents and traditional businesses, and of neighbourhood stalwarts ceding to global chains, souvenir shops, burger joints and nail bars.

![[Tourists on crowded tree-lined street]](https://i.guim.co.uk/img/media/a9491599d032ed7bd8e3e0c7d6614a4c95f1fc34/0_348_5222_3133/master/5222.jpg?width=445&dpr=1&s=none&crop=none)

The statistics that explain Spain’s housing crisis are equally jarring. Rents rose by 80% over the past decade, outpacing wage increases, and a recent Bank of Spain report estimated that almost half of the Spain’s tenants spend 40% of their income on rent and utility bills, compared with an EU average of 27%.

![[An aerial view of the Eixample neighbourhood with the Sagrada Familia cathedral in the foreground]](https://i.guim.co.uk/img/media/5f8ad50c614ed87edd77b5d923361c46361656e6/0_183_5183_3111/master/5183.jpg?width=445&dpr=1&s=none&crop=none)

The crisis – aggravated by the rising cost of living caused by property speculation and the boom in tourist flats – has become Spaniards’ biggest worry, and the focus of the latest policy duel between the governing socialists and their conservative opponents in the People’s party (PP).

![[A tourist couple walk past a banner reading ‘no tourist flats’ hanging from the balcony of a house]](https://i.guim.co.uk/img/media/36a697f7ba19970cbd77e2ebc835317c8852e887/0_197_4687_2814/master/4687.jpg?width=445&dpr=1&s=none&crop=none)

The prime minister, Pedro Sánchez, outlined a 12-point plan in a speech last Monday to ease what he called the country’s “housing situation emergency”, noting that social housing made up only 2.5% of Spain’s total stock, compared with 14% in France and 34% in the Netherlands.

![[Tourist on the balcony of their airbnb flat in Barceloneta]](https://i.guim.co.uk/img/media/f90eaa9da3c445db515387384e44e15267c6f6ff/0_403_3000_2786/master/3000.jpg?width=445&dpr=1&s=none&crop=none)