‘Asking Rachel Reeves to reverse 15 years of austerity in two years is unreasonable’

Share:

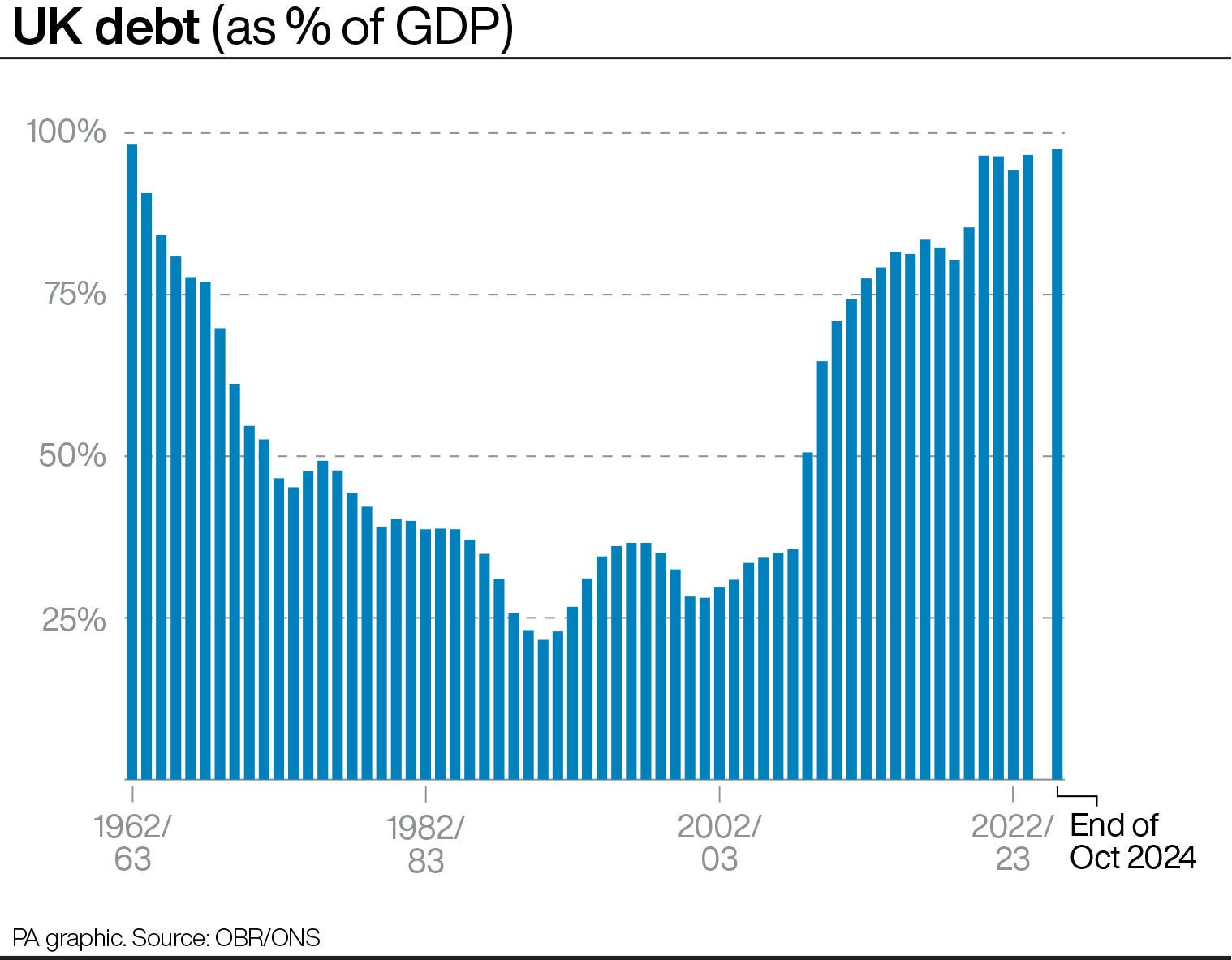

There might, just, be light at the end of the tunnel for the chancellor. Rachel Reeves was given a warning this month how the most carefully plotted budget strategy can be blown off track by turmoil in financial markets. Calm has been restored, for the time being, but the lingering effect has been to increase the UK government’s cost of borrowing.

If higher interest rates persist, the chancellor could be forced to allocate more of her budget to debt interest payments and, to stay within borrowing constraints, raise taxes or make spending cuts. A reduction in government spending to fund higher debt payments will be a blow to Reeves, who is desperate to kickstart economic growth. However, Treasury cash is not the only spur to economic activity.

The IMF says in its latest health check on the UK economy that while government spending is important (and it approves of the chancellor’s mix of higher taxes, modestly higher borrowing to pay for a revamp of public services), most of the UK’s growth this year will come from consumer spending.

It said strong wage rises for the majority of workers over the last two years and several interest rate cuts by the Bank of England will improve household finances, giving consumers the confidence to spend again. Inflation is beginning to come down again, unemployment remains low and the economy started to grow in November after a few months when it flatlined. Consumer confidence rose in December. So it looks like the economy is beginning to wake up after a long slumber. As a guide, IMF forecasts show the UK economy will expand by 1.6% this year compared with 0.8% in France and 0.3% in Germany.