Bad economic news brings end to market turbulence and interest rate benefits - as more cuts expected for 2025

Share:

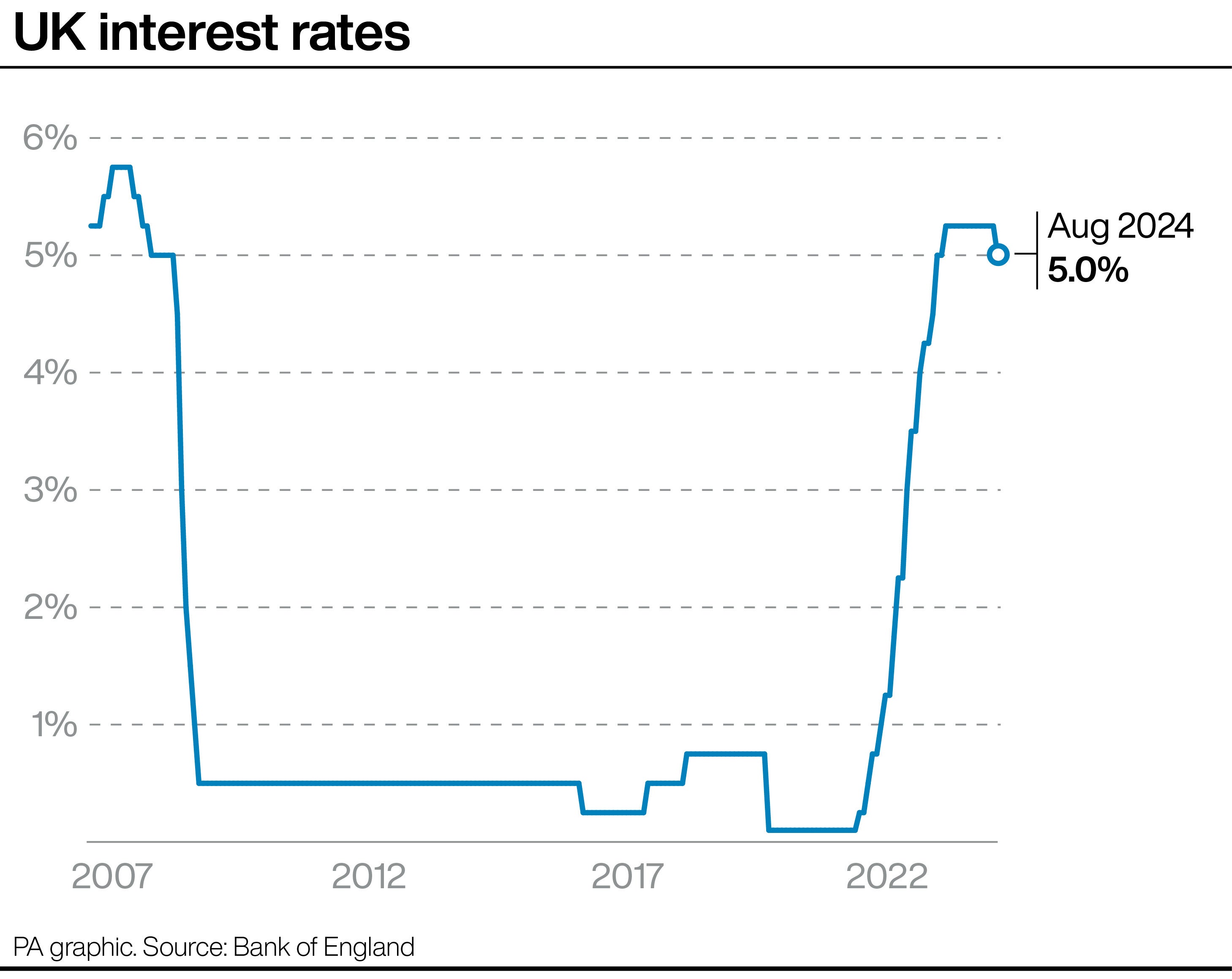

A week of news showing the UK economy is slowing has ironically yielded a positive for mortgage holders and the broader economy itself - borrowing is now expected to become cheaper faster this year. Traders are now pricing in three interest rate cuts in 2025, according to data from the London Stock Exchange Group.

Earlier this week just two cuts were anticipated. But this changed with the release of new official statistics on contracting retail sales in the crucial Christmas trading month of December. It firmed up the picture of a slowing economy as shrunken retail sales raise the risk of a small GDP fall during the quarter.

Money blog: Surprise as FTSE 100 soars to new record high. That would mean six months of no economic growth in the second half of 2024, a period that coincides with the tenure of the Labour government, despite its number one priority being economic growth.

Clearer signs of a slackening economy mean an expectation the Bank of England will bring the borrowing cost down by reducing interest rates by 0.25 percentage points at three of their eight meetings in 2025. Latest inflation data will be cause for concern for rate-setters.

Chancellor reminded of the political price of inflation by Bank of England. Interest rate cut - but budget means inflation will rise, Bank says. Please use Chrome browser for a more accessible video player. If expectations prove correct by the end of the year the interest rate will be 4%, down from the current 4.75%. Those cuts are forecast to come at the June and September meetings of the Bank's interest rate-setting Monetary Policy Committee (MPC).