Crest Nicholson swings to loss after ‘disappointing’ year

Crest Nicholson swings to loss after ‘disappointing’ year

Share:

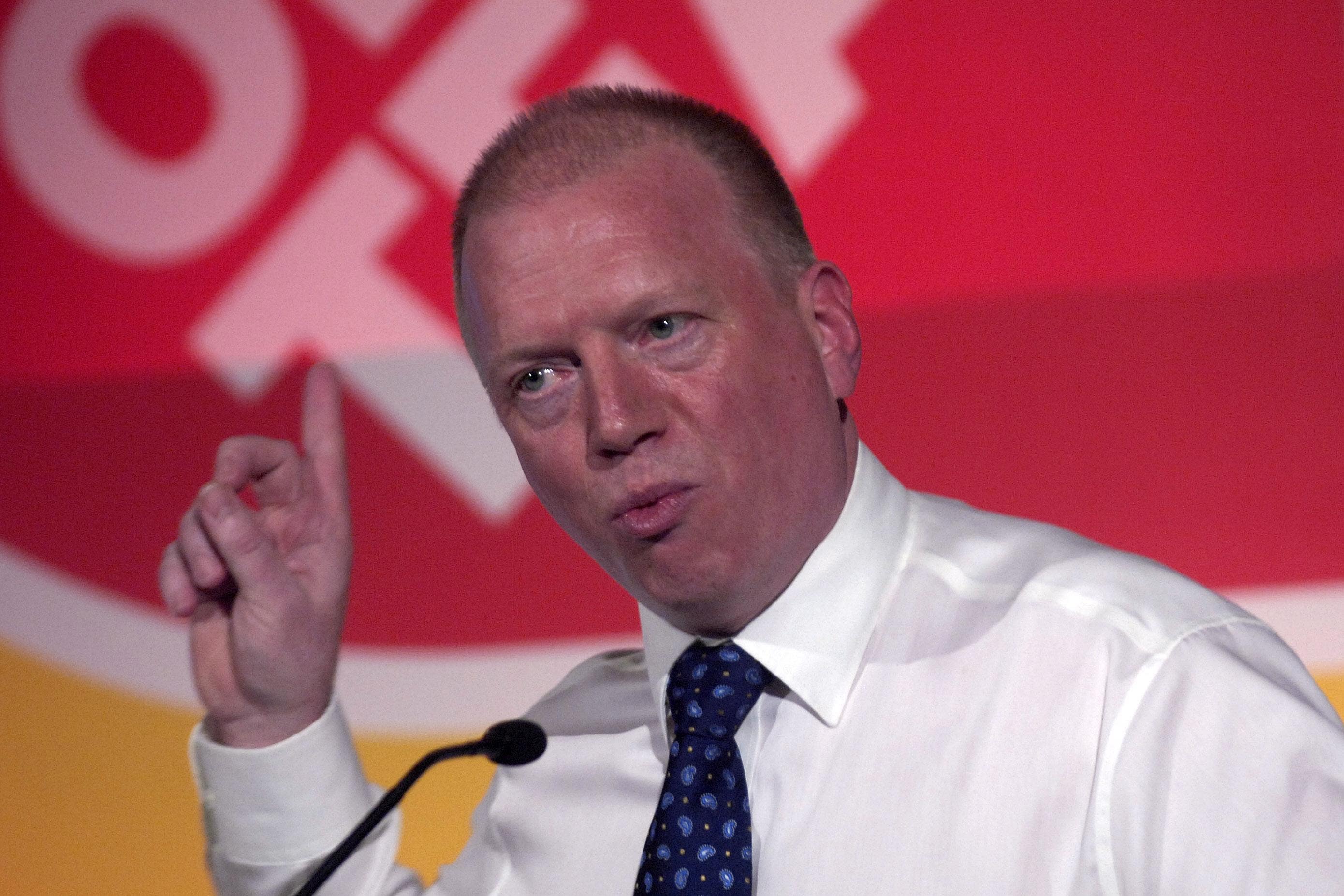

Housebuilder Crest Nicholson has slumped to a loss after a “very tough and disappointing” year. The group swung to a £143.7 million pre-tax loss for the year to October 31 against profits of £23.1 million the previous year. Crest saw the number of homes completed drop 7.3% to 1,873 and revenues fall 6% to £618.2 million. This has been a very tough and disappointing year for the business. Recently-appointed chief executive Martyn Clark said that, alongside wider market woes, the firm was also hit by previous failures to identify and implement appropriate internal controls, which he said “significantly” affected its financial performance.

“This has been a very tough and disappointing year for the business,” he said. Mr Clark took the reins in June last year, during a period in which rival Bellway was trying to buy the firm, with the company turning down a series of takeover bids. He also said the tough year came a result of high interest rates and subdued consumer confidence. “While economic and political challenges persist, I am cautiously optimistic about the year ahead,” he said.

Crest is hopeful that the market will stabilise more over the second half of 2025 thanks to pent-up demand, but warned that expectations for the Bank of England to cut interest rates at a slower pace is hampering buyer demand. It forecast that, on an underlying basis, profits over the year ahead are expected to be in the range of £28 million to £38 million, against £22.4 million reported in 2023-24.

Early indicators ... are encouraging, though we remain mindful of macroeconomic uncertainty and the pace of interest rate reductions and the impact this may have on 2025 profitability. Crest said: “Recent weeks have shown an ongoing incremental improvement in sales performance, supported by encouraging early indicators such as increased website visits and follow-up appointments. “However, the slower-than-anticipated pace of interest rate reductions continues to weigh on the ability to convert indications of interest and is tempering the housing market recovery.”.

The Bank of England is widely expected to cut rates on Thursday from 4.75% to 4.5% amid lower inflation and faltering UK economic growth. But rates have been falling at a slower rate than first expected, due in part to stubborn inflation and rising wages, which has hit the housebuilding sector. Mr Clark said: “Early indicators, including increased customer interest and inquiries and sales rates in January, are encouraging, though we remain mindful of macroeconomic uncertainty and the pace of interest rate reductions and the impact this may have on 2025 profitability, which remains below long-term averages.”.