Reeves to water down tax raid on non-doms after exodus of millionaires

Share:

The chancellor is to amend some of the changes to tax rules for non-domiciled individuals announced in October’s Budget. Rachel Reeves is watering down her tax raid on non-doms after it contributed to an exodus of millionaires from the UK. The chancellor is to amend some of the changes to tax rules for non-domiciled individuals announced in October’s Budget.

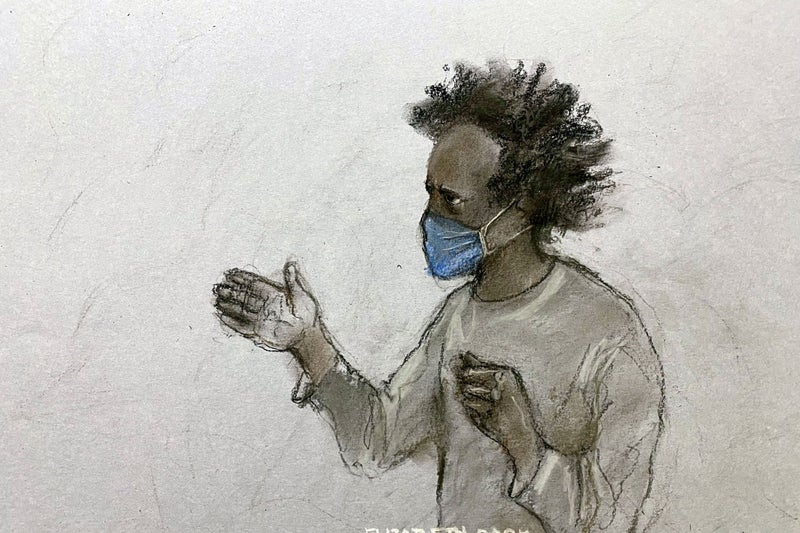

![[Many wealthy individuals leaving Britain have blamed Labour’s Budget]](https://static.independent.co.uk/2025/01/13/13/1bb941d4ea5c5c64372b8da5ba5ba400Y29udGVudHNlYXJjaGFwaSwxNzM2ODU4NjI1-2.77551831.jpg)

Speaking on the sidelines of the World Economic Forum in Davos, Ms Reeves said the government will table an amendment to the finance bill to address some of the concerns raised by non-doms. She told Wall Street Journal editor Emma Tucker: “We have been listening to the concerns that have been raised by the non-dom community.”.

One planned change will be to the expand temporary repatriation facility, which lets non-doms bring income and capital gains into the UK with a minimal tax bill. And the chancellor offered reassurance to non-doms worried about becoming liable for double taxation, adding: “There’s been some concerns from countries that have double taxation conventions with the UK, including India, that they would be drawn into paying inheritance tax.

“That’s not the case: we are not going to be changing those double-taxation conventions.”. A Treasury source told The Times: “We’re always interested in hearing ideas for making our tax regime more attractive to talented entrepreneurs and business leaders from around the world to help create jobs and wealth in the UK.”.

The non-dom tax loophole, which lets foreign nationals living in Britain avoid paying tax on overseas earnings, was thrust into the spotlight when The Independent first revealed that Akshata Murty, Rishi Sunak’s wife, had used it to save potentially millions of pounds.