Shell boss dismisses Reeves' 'game changer' green fuel for Heathrow claim

Shell boss dismisses Reeves' 'game changer' green fuel for Heathrow claim

Share:

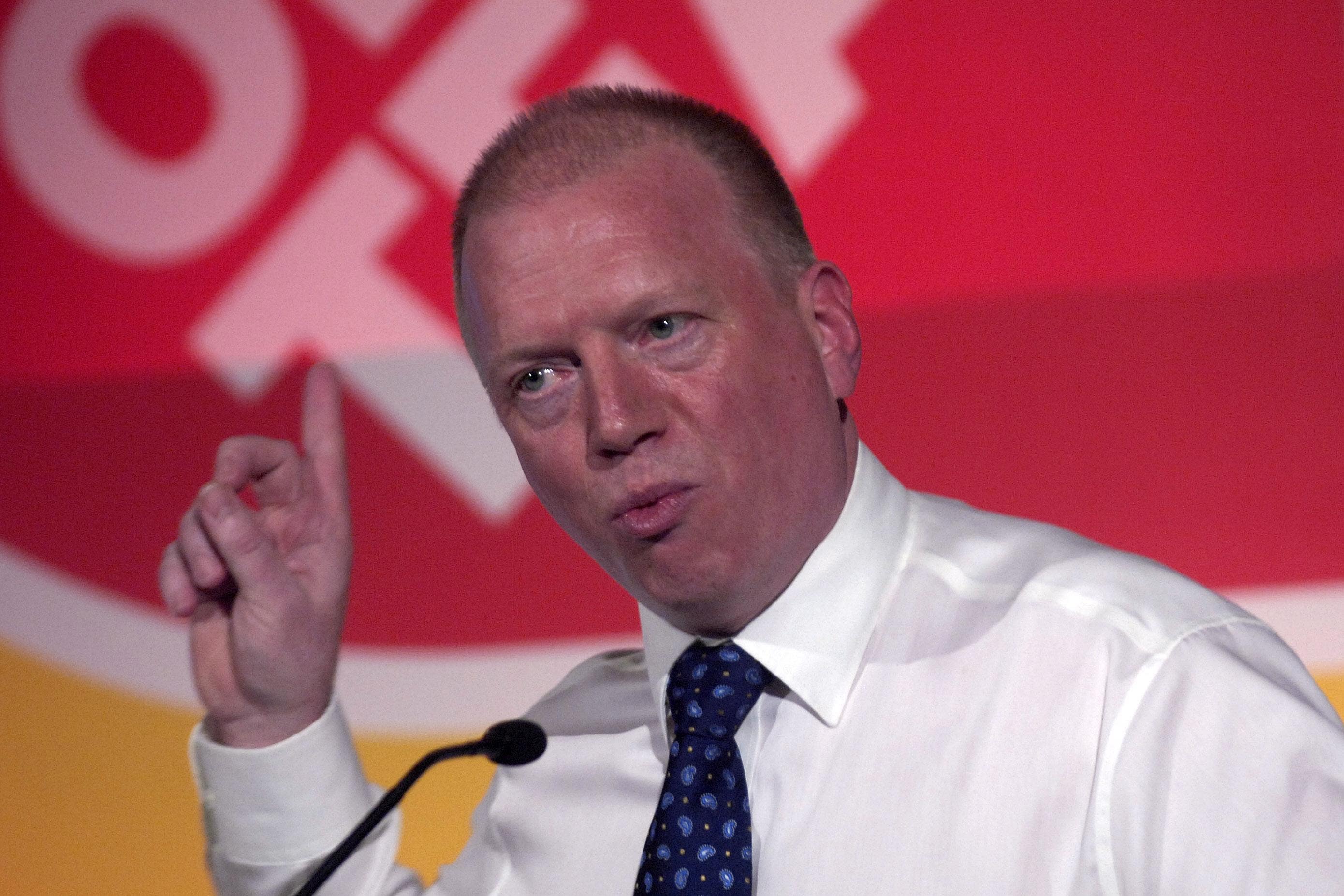

Wael Sawan, the chief executive of oil giant Shell, said that sustainable aviation fuel is expensive and that airlines will be slow to take it up. Last week, the Chancellor described SAF as “a game-changer in the way that we fly and the carbon emissions” as she backed another runway at Britain’s biggest airport and said carriers could be using it by 2035. It is expensive to make compared with jet fuel, which is refined from oil.

It can be made from cooking oil or waste but the greenest fuel must be made from wind power, splitting water molecules into hydrogen and oxygen and then combining the hydrogen with carbon monoxide from the air to make a chemical identical to jet fuel, an even more costly process. He said: “The reality is that SAF is more expensive and therefore unless there are mandates — obligations on either customers or airlines — it is difficult to see a penetration that is going to be massive.

“SAF is truly the only solution for the aviation sector, I think, for at least the next ten to 15 years — and it will grow. But I think, just from a fundamentals basis, it grows from a low base. I mean, airlines will not simply erode their bottom lines for the sake of it.”. In December, the UK set rules demanding that 10 per cent of jet fuel demand should be from SAF by 2030 and 22 percent by 2040.

Shell supplies SAF to some of the biggest airports in Europe, North America and Asia. But there are concerns about countries weakening their rules, including the US under President Donald Trump, which would make the fuel uncompetitive. Mr Sawan said: “We talked about $10 to $15 billion to be invested by Shell over the three-year period up to 2025. We’ve invested eight of that and we’re on track to reach that range but what we are seeing is backsliding in biofuels mandates and biogas mandates and that if anything will erode confidence for the future to invest further.”.