Shell leaving London Stock Exchange ‘not a live discussion’ as dividends are raised

Shell leaving London Stock Exchange ‘not a live discussion’ as dividends are raised

Share:

The energy major said profits fell after a year of operating in ‘a lower price environment’. Shell has hiked its dividends to shareholders despite profits falling last year, after the energy giant was hit by weaker oil prices and lower demand for the fossil fuel - and said they are not presently looking at shifting their primary market listing overseas.

The London-listed company raised its dividend by 4 per cent while posting earnings of US$23.7bn (£19.1bn) for the calendar year, down from $28.3bn (£22.8bn) in 2023. Shell also said it had hit a cost-cutting target of $3bn (£2.4bn) after setting the goal in 2022.

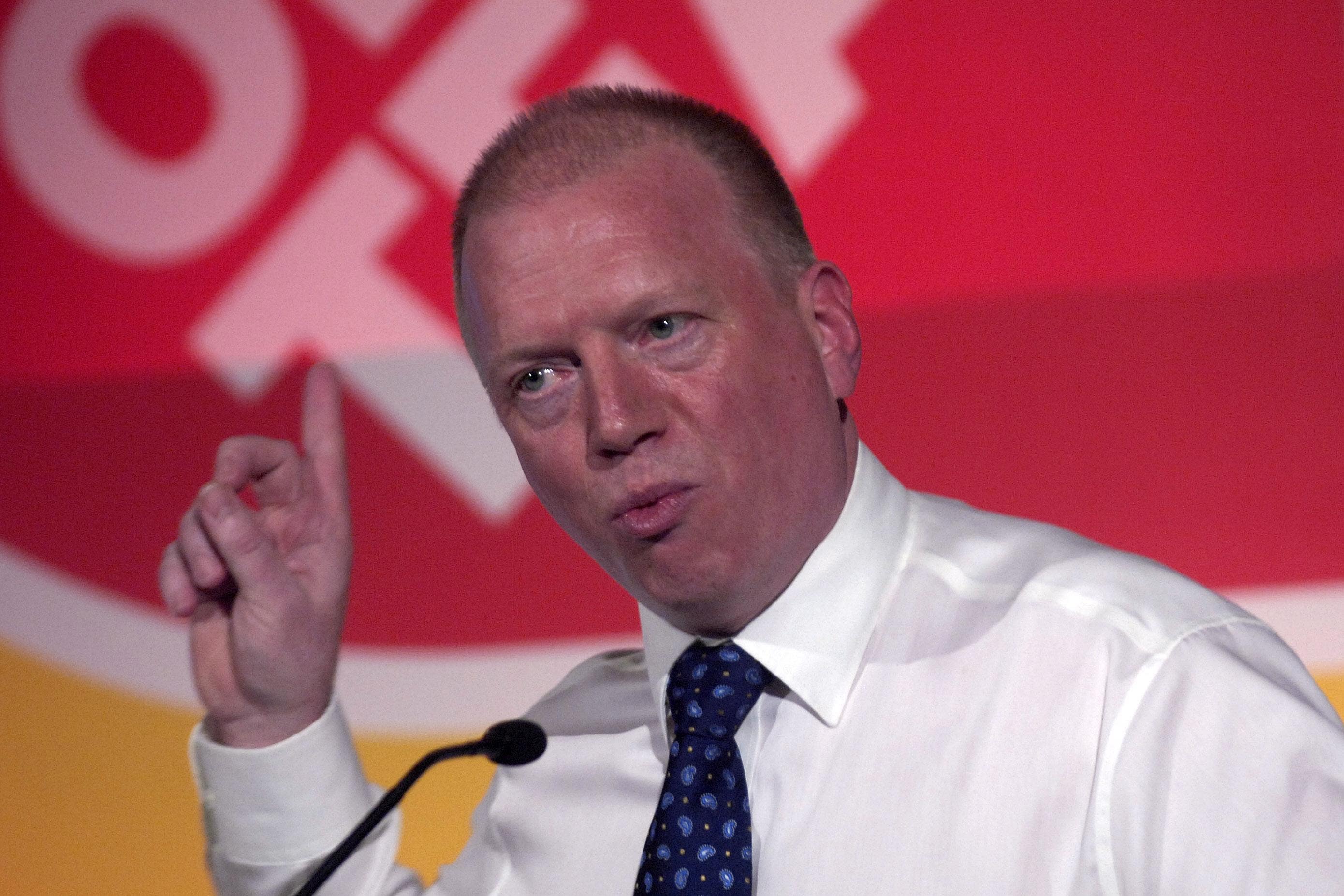

The company, which has been reported to be considering moving its stock market listing from the London Stock Exchange to the US, said it is keeping its current listing “under review”. However, chief financial officer Sinead Gorman said moving the listing is “not a live discussion for us” currently.

After a year of enormous outflows for the LSE, the biggest since the global financial crisis, keeping one of its biggest players on board will be seen as a win - but AJ Bell investment director, Russ Mould, cautioned that it could only be a for now situation.

“A strategy update in March is an opportunity for [CEO Wael] Sawan to lay out the next steps. The fear in the London market is that this update includes shifting the primary listing out of London and to the US, where Sawan could argue the investment case might get a kinder hearing,” Mould said.

Shell and BP have been trying to close valuation gaps towards similar levels that the major US-based oil players enjoy, which would come around from a bump-up in share prices. Several companies have switched UK for the US in a bid to do the same, with more exposure and liquidity in that market.