The growth versus inflation bind now visible at the Bank of England

Share:

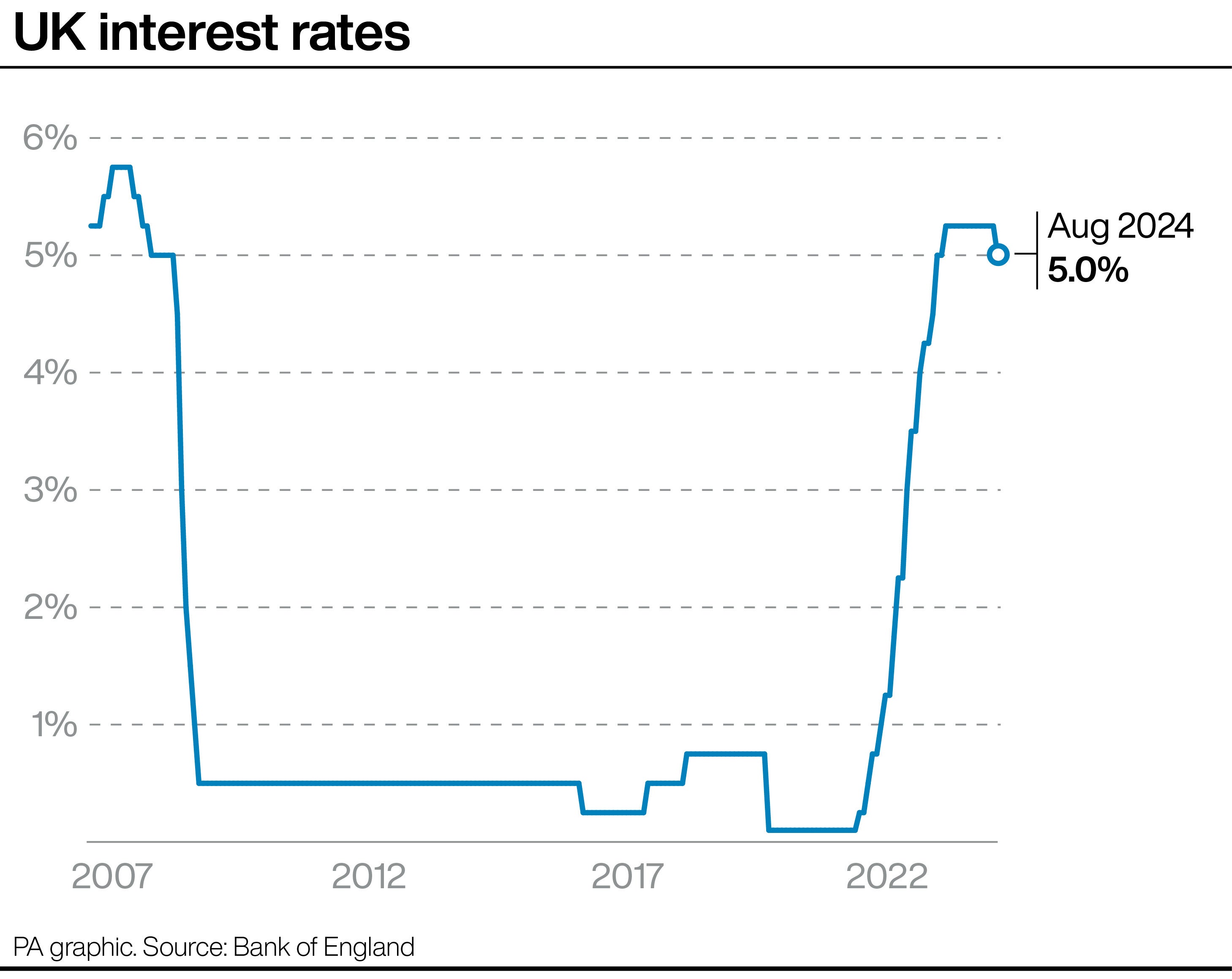

Very few will be surprised by the Bank of England’s decision to keep rates on hold a 4.75%. What is more striking is the policy rift that has emerged. Three members of the rate-setting committee voted to cut rates while the other six opted to keep them as they are.

It reflects some of the competing challenges facing the economy. Inflation is climbing with underlying pressures proving stubborn. At the same time the economy is flatlining and in desperate need of a boost. This is the growth versus inflation bind trapping central bankers.

Money latest: How mortgage experts view Bank's interest rate decision. It is also exercising the markets. There have been some big swings over the past week, with investors paring back their bets on the trajectory of the interest rates. Hopes of one more cut before Christmas were all but dashed after a slew of economic data gave central bankers cause for concern. The big one was wage growth, which is considered a harbinger of rising prices.

Average earnings rose by 5.2% in the three months to October, welcome news to many after the sustained fall in living standards we've experienced over the past few years. However, it's too high for the Bank of England's liking. Bank of England keeps 'gradual' cut prospects alive as interest rate held.

Money blog: Interest rate held at 4.75% after November inflation rise. Thames Water fined £18m by Ofwat for breaking shareholder payment rules. Then the inflation rate for November came in at 2.6%. That was above the Bank's 2 % target but broadly in line with expectations. Nevertheless, it is higher than where the Bank thought it would be around this time of the year when it published its most recent forecasts last month.