Workers for Consumer Financial Protection Bureau describe chaos and fear as lawsuits and basic functions grind to a halt. The termination email for a score of employees at the top US consumer watchdog arrived in the late hours of the night. “Unfortunately, the Agency finds that you are not fit for continued employment because your ability, knowledge and skills do not fit the agency’s current needs,” dozens of probationary staffers at the Consumer Financial Protection Bureau (CFPB) were informed on 11 February.

“For these reasons, I regrettably inform you that I am removing you from your position of [job title], with the agency and the federal service [effective date],” continued the letter from Adam Martinez, CFPB’s chief human capital officer and seen by the Guardian. The CFPB has long been known as a popular agency, one that’s recovered more than $21bn for defrauded Americans since its creation in the wake of the 2008 financial crisis. But now it faces the threat of dismantlement, and becoming the next institution under the Trump administration to potentially be rapidly hollowed out from within – a situation that could cause consumers the need to fend for themselves against predatory financial practices. More broad layoffs may be on the way.

“It’s been really stressful to potentially lose my way to support my family as the primary breadwinner,” said one of several CFPB employees who spoke on condition of anonymity due to fear of retaliation. “But the chaos that’s happening is impacting not just the bureau, but consumers and industry.”. The trouble began earlier this month, when the newly appointed acting director, Russell Vought, issued a sweeping order halting all agency operations. Staff were instructed not to perform any work tasks without explicit written approval. The agency’s headquarters was abruptly closed, its website went dark, and its social media accounts were deleted.

“This has been unprecedented,” said a second CFPB employee, who joined the financial watchdog just before Trump’s first term. “No administrative tasks, no trainings, we can’t do anything. We were in the middle of exams, doing what we do. And now there are open questions about everything.”. The freeze has left both CFPB staff and the financial institutions they oversee in limbo. Ongoing examinations have been suspended mid-process. Statutory deadlines loom with no one authorized to handle them. Even routine consumer-protection functions have ground to a halt.

“Right now, they’re not allowed to proceed with any kind of court cases,” a third employee explained. “Any of these cases they’re litigating against any kind of bank is presumably going to be thrown out, which really sucks.”. The work stoppage came with a twist: the possible installation of surveillance software on employee computers just days before the shutdown, two current staffers told the Guardian.

“People are almost scared to work. There are concerns of keystrokes being monitored,” the first CFPB employee said. “No one wants to get fired for insubordination.”. “I would have it open and I’d be, like, jiggling my mouse to keep it green,” the second employee said, “if only because I’m just extremely nervous about what the consequences are of a work stoppage.”. The CFPB did not return a request for comment.

This climate of fear has only been amplified by the tech billionaire Elon Musk’s so-called “department of government efficiency” team, who were granted access to CFPB’s headquarters and computer systems. Hours after their arrival, Musk posted “CFPB RIP” with a tombstone emoji on his social media platform, X. The CFPB holds vast amounts of sensitive consumer and corporate data, raising serious security concerns. The bureau maintains one of the federal government’s largest consumer-complaint databases, containing millions of detailed records about Americans’ personal financial struggles, from mortgage difficulties to credit card disputes. This includes social security numbers, account details and comprehensive financial histories.

“Companies submit confidential business information, trade secrets and information about consumers,” the third employee went on. “People reveal very personal, sensitive information, and it seems like there has been very little regard towards protecting that.”. Sign up to Headlines US. Get the most important US headlines and highlights emailed direct to you every morning. after newsletter promotion.

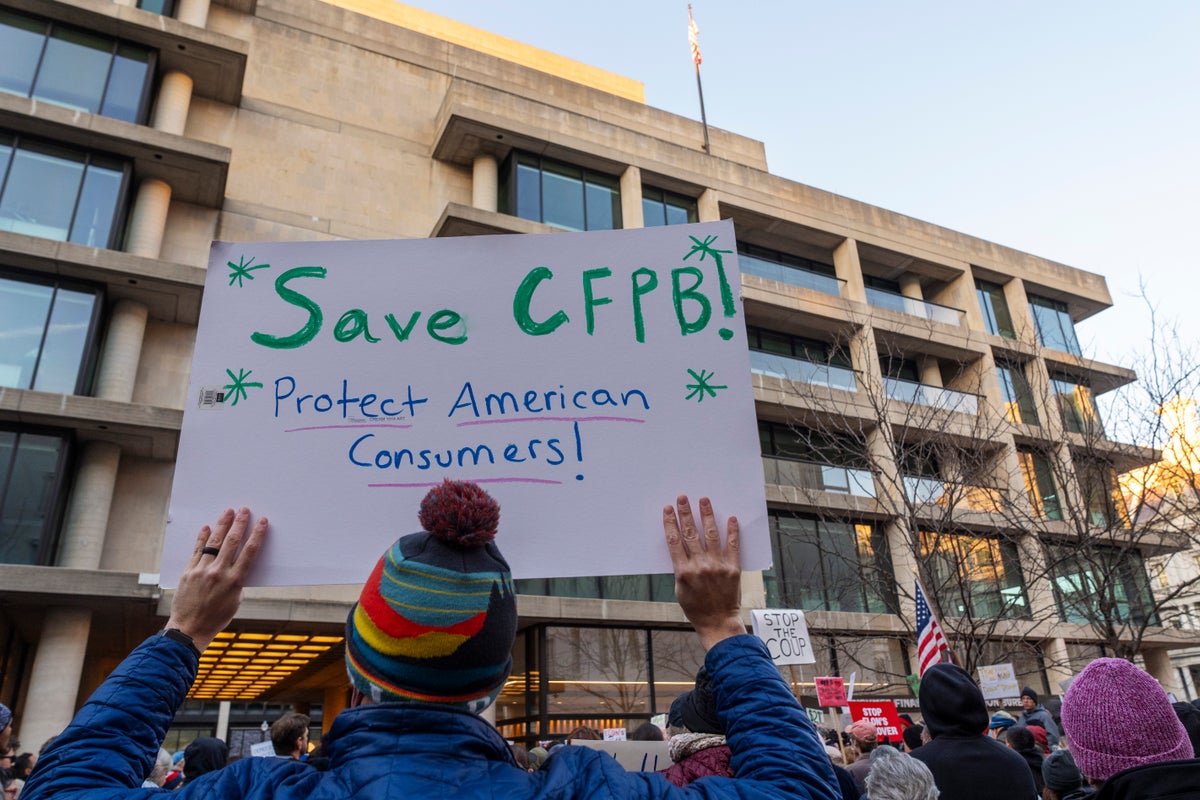

Meanwhile, the administration is preparing for even more dramatic cuts. According to legal filings from a federal workers’ union on Thursday, plans are believed to be under way to terminate more than 95% of the bureau’s employees, in effect rendering it impossible for the agency to fulfill any of its statutory functions. Another legal filing from the union that represents CFPB employees on Friday seeks an injunction to prevent further disruption, arguing that Vought’s moves violate separations of powers by obstructing Congress’s mandate to protect American consumers.