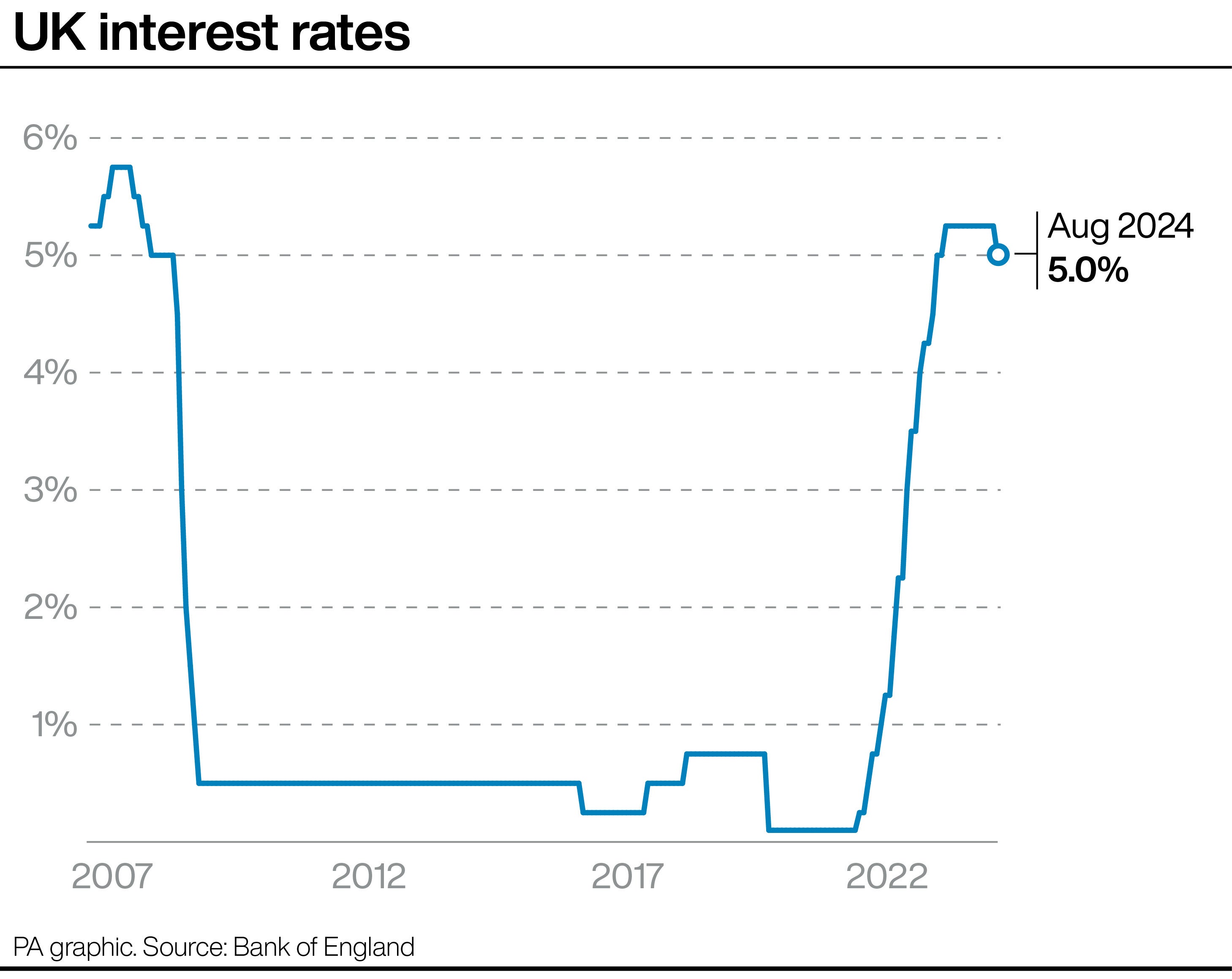

An influential economic research firm predicts interest rates will fall to 2.5 per cent by late 2027, a much bigger drop than the 3.75 per cent market consensus. Economists at Oxford Economics think the Bank of England will cut interest rates far further than financial markets are currently forecasting.

The market forecast is that rates will fall to 3.75 per cent by the end of 2025, and then settle at around that level and become the new normal. However, Oxford Economics believes the downward momentum will continue through 2026 and 2027, with rates settling at around 2.5 per cent.

Andrew Goodwin, chief UK economist at Oxford Economics says the difference is partly because financial markets are anticipating higher inflation than they are, but also partly because of demographic changes. Outlier: Oxford Economics has raised its long-run forecast for interest rates from 2% to 2.5% but it's still much lower than markets expect.

'Over the longer-term, the level of interest rates tends to be determined by structural factors, such as demographics and productivity growth,' says Goodwin. 'Before the pandemic, interest rates were very low largely because the population was ageing and productivity growth was very weak.

'Once the bout of high inflation has passed, we expect these structural factors to reassert themselves. 'The drag from demographics is likely to be similar over the coming decade to the pre-pandemic period, particularly given the state pension age is due to increase by only one year.