Bank of England interest rate cuts are a much-needed boost for the economy

Bank of England interest rate cuts are a much-needed boost for the economy

Share:

Editorial: The quarter percentage point cut surprised no one but it is still more significant than it sounds – and we can expect Rachel Reeves to make the very most of it in the weeks ahead. Like a ray of sunlight through a break in the winter clouds, the reduction in interest rates by the Bank of England offers a glimpse of better times to come for the economy. It was also a rare piece of encouraging news for the government – and we may expect ministers to make the very most of it in the weeks ahead.

As is the Bank’s custom of taking “baby steps” and the usual tendency to conform – rather than defy – market expectations, the quarter percentage point cut surprised no one, but it is still more significant than it sounds. It is, after all, the cut that was actually hoped for last December, but had to be postponed because of trends in market rates for gilts – and further evidence about the persistence of domestically generated inflation (in particular, in the growth in wages still outstripping any improvements in overall productivity).

Ever since the annual inflation rate peaked at 11.1 per cent in October 2022, the governor of the Bank, Andrew Bailey, always maintained that the “last yards” in the struggle to get inflation sustainably back to the official 2 per cent target would be the hardest. He was commendably candid about the challenges facing the Bank’s Monetary Policy Committee (MPC) – and that has helped sentiment and bolstered confidence in policymakers, at least on the monetary side.

Disturbingly, the Bank thinks that adverse movements in gas prices will push headline inflation back up to 3.7 per cent, but temporarily; the underlying factors affecting prices are more benign. There is, though, some poignant irony in the fact that the Bank has felt able to make this move because of concerns about the prospects for demand and growth. The central fact is that the economy is stagnating, which depresses inflation and makes it safer for the Bank to ease monetary policy further. The Bank's own forecasts are gloomy – downgrading the growth figure for 2025 from 1.5 per cent to 0.75 per cent, with a contraction in the final months of 2024.

It is fair to say that business and consumer confidence have both weakened more than was expected, or intended, in the first weeks of the Labour government; and the “tough decisions” taken by the chancellor, Rachel Reeves, in her October Budget didn’t help matters much. Indeed, the most significant tax hike, the £25bn to be extracted from business in higher employers’ national insurance contributions is yet to be implemented, and the squeals of pain from companies are growing insistent.

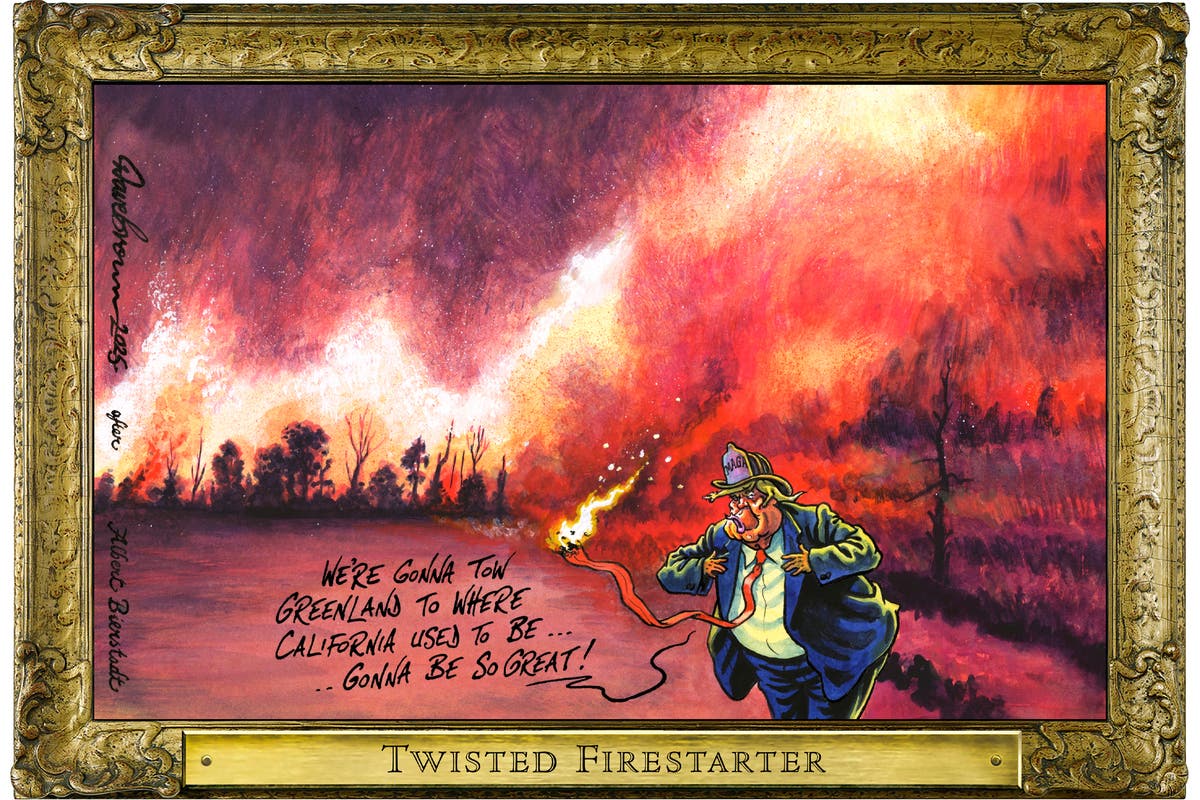

The Bank is also more than aware of the threat to world trade posed by the wave of tariffs that could throttle global growth, and for which the blame can be solely allotted to Donald Trump. Even if it escapes the worst of his punitive imposts, Britain’s status as an unusually open economy means it is especially vulnerable to setbacks abroad, and even more exposed to its two largest export markets – the European Union and the United States. Rarely has the outlook for trade been more gloomy. It is another reason why the Bank is actually erring on the side of caution in cutting rates again.

For Ms Reeves, a former Bank employee herself, as she likes to remind us, the important thing is that interest rates are firmly on a downward trajectory, albeit for bad as well as good reasons. The voting on the Bank’s MPC shows that some members wanted a rate cut of a half percentage point, another encouraging sign. Some 640,000 homeowners on tracker mortgages will see an immediate uplift in their household income. In due course, other mortgages and the cost of capital to businesses will also drift lower – both very welcome relief after the harshest episodes in the cost of living crisis, and should push productive investment higher.

Politically, the chancellor can claim that the trend vindicates the various unpleasant surprises and broken promises she unleashed on the British public last year, as being necessary to fill the infamous £22bn “black hole” left by the Conservatives, and to place the public finances on more secure foundations. She is right to say that only with a sound fiscal framework can a looser monetary policy be accommodated, but she, like the members of the MPC, has a balancing act to perform.

She has not yet definitively demonstrated to the exclusion of reasonable doubt that the public finances are indeed on that footing, and the “headroom” she has created for herself in case of forecasting errors, bad luck and accidents is excruciatingly tight. Recent weeks have seen a frenzy of announcements and cheesy photo opportunities to promote the government’s growth agenda, such as the expansion of airports, transport investment and green energy. So much so, indeed, that Ms Reeves seems to have adopted a hard hat and hi-vis jacket as her informal work uniform.