Reeves responsible for collapse in growth, say economists

Share:

Europe’s second largest bank has slashed its forecasts for growth in the British economy following turmoil in financial markets and weak official data. Paris-based BNP Paribas said it expects UK GDP to expand by 1.1pc this year, down from its previous estimate of 1.4pc.

It comes after official figures showed the economy grew 0.1pc in November, which was lower than analyst forecasts of 0.2pc. The bank said it expected UK GDP to hit 0.8pc for 2024, down from its last projection of 0.9pc, as growth appeared close to 0pc in the final three months of the year, below its previous expectation of 0.3pc.

Europe economist Dani Stoilova said the bank felt “more caution, less optimism” after a surge in bond yields at the start of the year amid concerns that Chancellor Rachel Reeves will not be able to meet her fiscal rules. She said: “We entered the year with a cautiously optimistic view on the UK outlook.

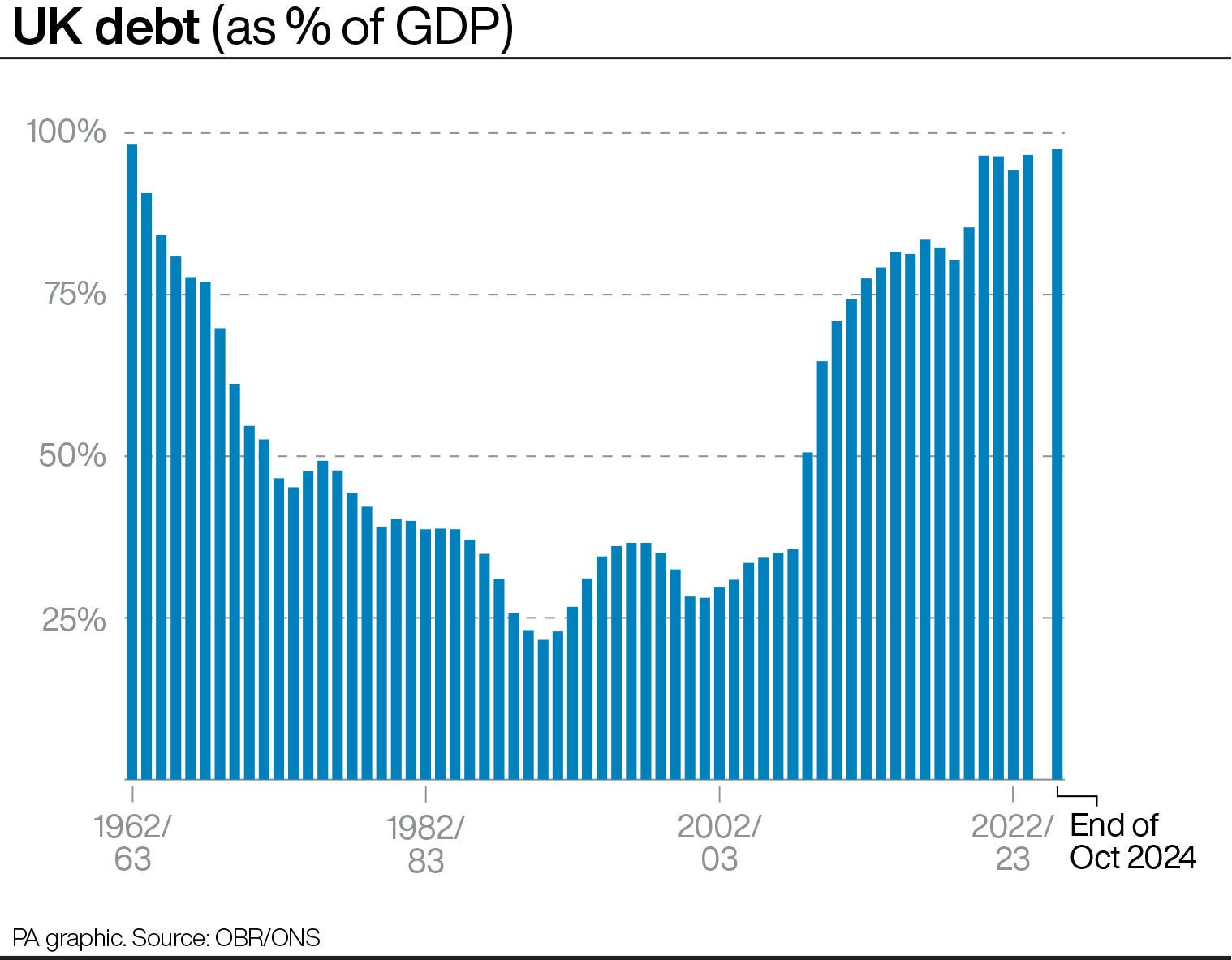

“Since then, elevated gilt yields, currency weakness, and downside surprises to activity data have jolted UK markets and sentiment. “These moves have, at least in part, been underpinned by growing concerns that the UK is entering a period of stagnation and further amplified by concerns about debt sustainability.”.

The downgrade means the UK economy is still on track to grow slightly more than France and Germany this year, where BNP Paribas forecast GDP will rise by 0.4pc and 0.8pc respectively. But lower expectations will be a major headache for Ms Reeves as it looks increasingly likely that the Office for Budget Responsibility (OBR) will cut its own forecasts for UK economic growth at its spring statement in March, a move that will further erode the margin by which the Chancellor can meet her borrowing targets.