The best savings accounts for 2025? banking experts reveal predictions for savers

Share:

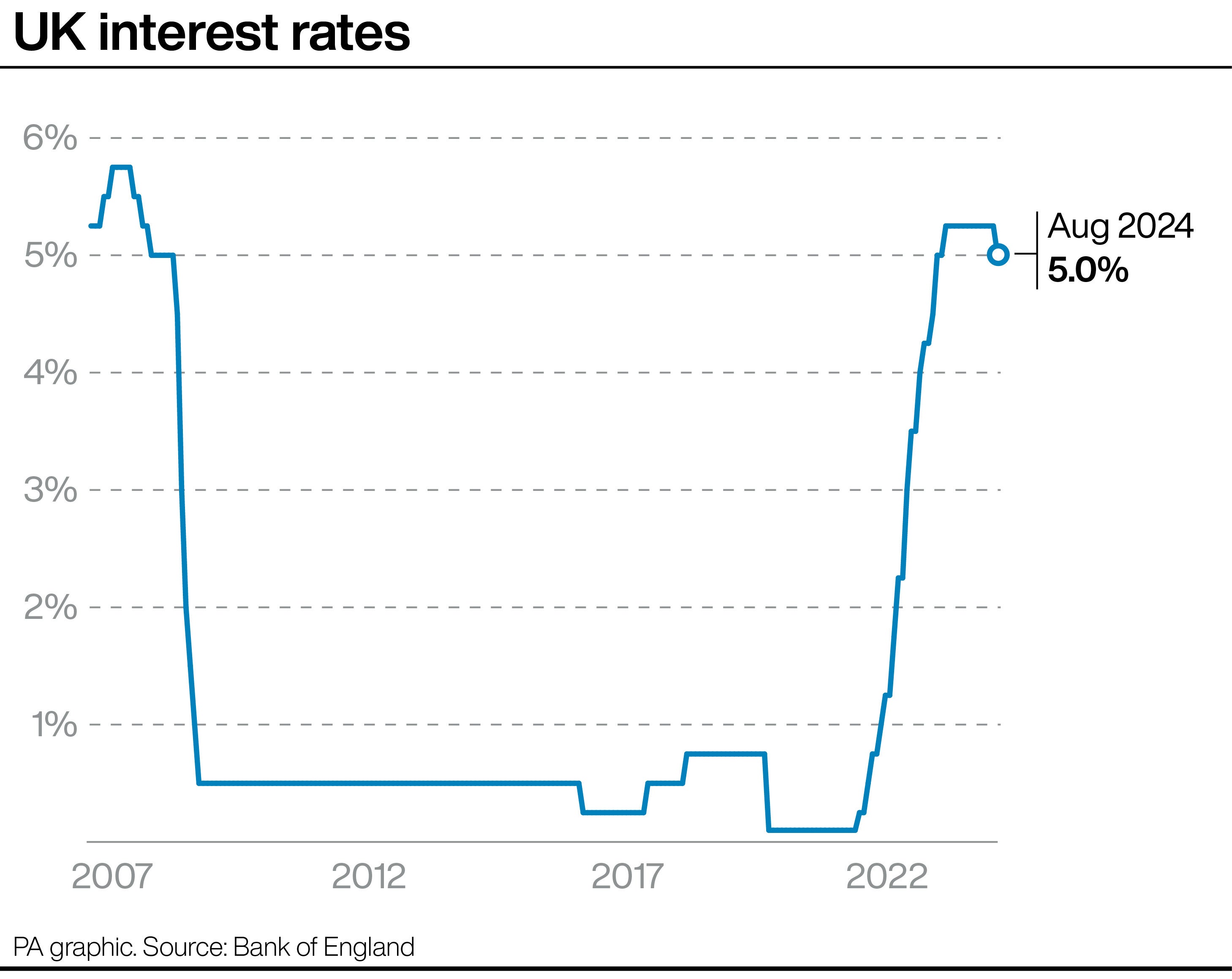

INTEREST rates on savings accounts levelled off last year - but what's in store for 2025?. Savings rates surged in 2023 following successive Bank of England (BoE) base rate rises. Any rise in the base rate is designed to slow inflation and also sees savings rates go up.

![[We reveal what could happen to savings rates in 2025]](https://www.thesun.co.uk/wp-content/uploads/2024/12/2k2a87y-need-cash-cropped-shot-860084760.jpg?strip=all&w=960)

But with the base rate peaking last year and then ratesetters dropping it from 5% to 4.75% in November and keeping it there in December, savings rates have started to fall. What's in store for 2025 though, and which banks and building societies offered the best deals in 2024?.

![[The banks and building societies that appeared in the best buy tables the most times in 2024]](https://www.thesun.co.uk/wp-content/uploads/2024/12/SC_GRAPHIC_best-banks-savings1.jpg?strip=all&w=705)

The Sun spoke to Moneyfactscompare.co.uk and Hargreaves Lansdown to find out their predictions for the year. Moneyfacts also revealed the best buy tables for savings accounts for each month of 2024. We then crunched the data to find out who appeared in those tables the most times across the 12-month period.

![[Banks and building societies that appeared in the best buy tables the most times in 2024]](https://www.thesun.co.uk/wp-content/uploads/2024/12/SC_GRAPHIC_best-banks-savings2.jpg?strip=all&w=564)

At the time of writing, the base rate stood at 4.75%, down from 5% previously. Further rate cuts are expected in 2025, with the Governor of the BoE Andrew Bailey previously stating there could be as many as four. However, steadily rising inflation since then, has seen the central bank opt for a more cautious stance.

Last month, Mr Bailey said the central bank needed to make sure inflation, which sat at 2.6% in the 12 months to November, returned to its 2% target on a "sustained basis". He added "a gradual approach to future interest rate cuts remains right", signalling there might not be as many as four in 2025.