Voices: China won’t take Trump’s trade assault lying down… here’s how

Voices: China won’t take Trump’s trade assault lying down… here’s how

Share:

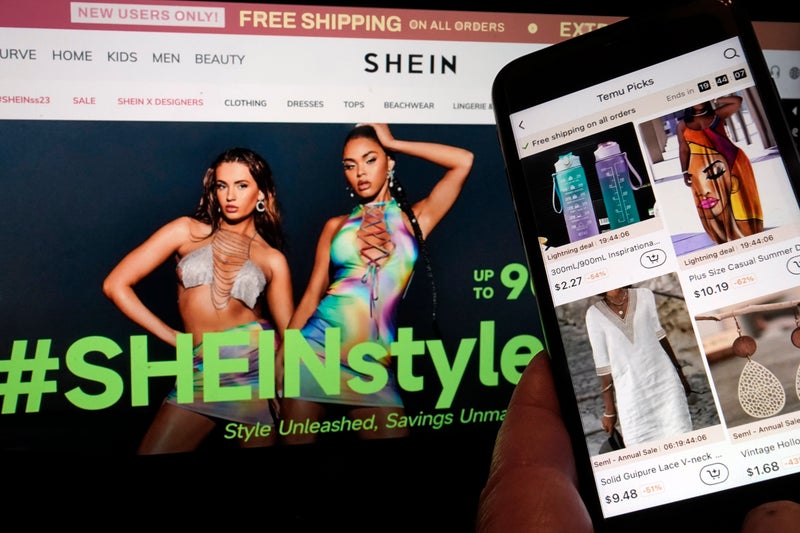

Trump’s impact on e-commerce, which he sees as a no-lose proposition, has unsettled Xi and his policymakers. Michael Sheridan explains how they’re fighting back. Asia has woken up to a new shock in the trade war. In a move as simple as it is drastic, the United States has suspended the shipment of small packages from China and Hong Kong, striking a huge blow to e-commerce giants like Shein and Temu.

Shein is planning a £50 billion listing on the London Stock Exchange, a centrepiece of the Labour government’s strategy to attract investment and boost the City’s appeal. However, that may have just become more complicated. Millions of items destined for American buyers of cheap clothes and other goods are piling up in sorting offices. The US Postal Service has not said when it will lift the ban, but that’s unlikely to happen soon. President Donald Trump has stopped an exemption allowing packages worth less than $800 (£641) to be sent duty-free.

Simple, yes, but bewildering. Why stop American consumers from getting the bargains they’ve already paid for? Many of them, perhaps, are less well-off people who voted for the president. Until you see how this fits into the Trump Shock strategy. Allow me to explain. In 1930, the last time the world experienced a fit of protectionism, the United States passed the Tariff Act. It set a benchmark at which dues were not imposed on imports. The legal principle was the Latin tag de minimis non curat lex: the law does not concern itself with trifles. In recent years it was raised to its present level of $800.

Nobody in 1930 imagined that one day Chinese e-commerce behemoths would use this obscure law to find a loophole to ship their products directly to American buyers, undercutting local competition and avoiding US customs duties. But they did. The result was an explosion in Covid-era shipments of packages by Chinese discounters. In 2019 items sent to the US from the rest of the world under the de minimis exception were worth $5.3 billion, according to the Congressional Research Service. In 2023 they were worth $66 billion. Two-thirds of these packages were sent from China.

American law enforcement agencies said some of them contained illegal items such as the opiate Fentanyl, its precursor chemicals and other prohibited drugs. Lawmakers began to compare the flood of unchecked packages to the arrival of migrants across the US borders. It was, in short, another issue crying out to the Trump administration for a quick fix. Nobody knows how it will be enforced; in theory, millions of parcels will have to be inspected by US Customs agents. But there is method in the apparent madness.

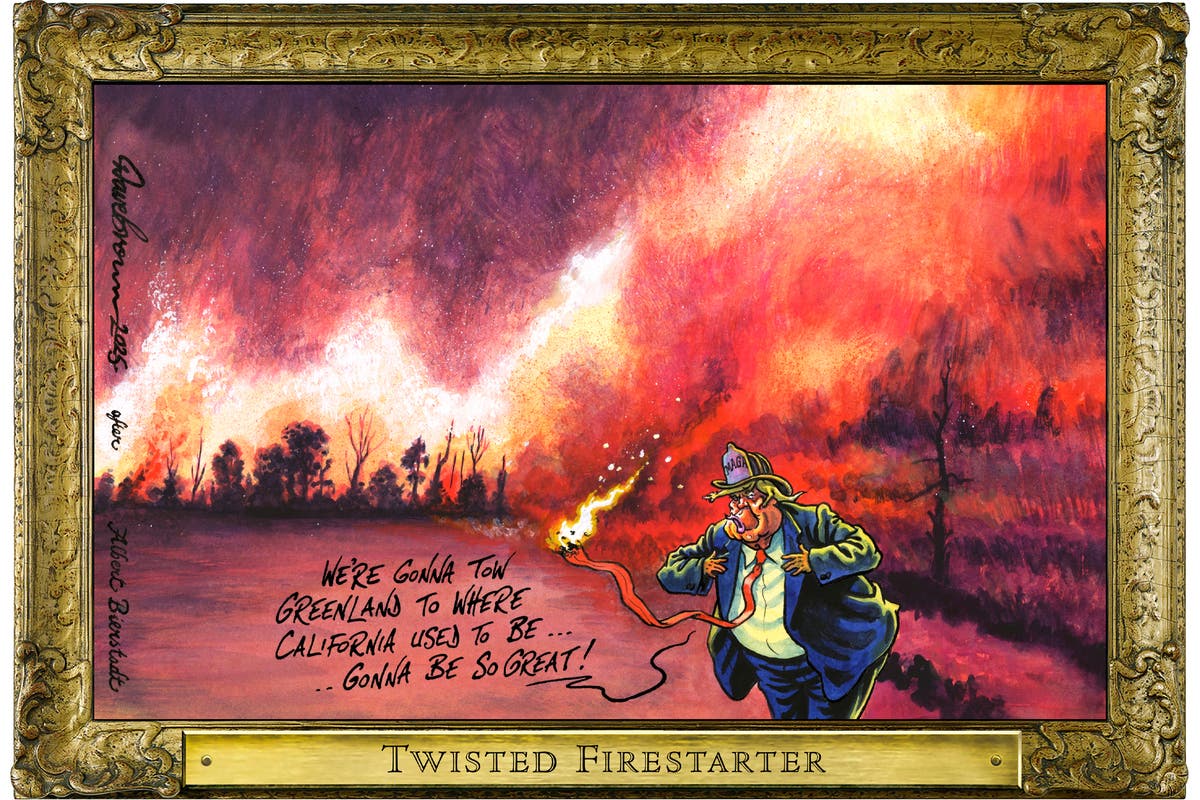

America is sending a signal that it will use insurgent tactics to fight the trade war while China is engaged in cumbersome statist tit-for-tat reprisals. That sows uncertainty across the Asian export economies, forcing leaders and businesses to adapt. So far, President Trump has not spoken to President Xi Jinping about the Trade Wars. He has indicated he’s in no hurry to do so. But the Chinese leader is not sitting idly by. This week he is welcoming the Prime Minister of Thailand, Paetongtarn Shinawatra, who is making a four-day visit to China. She says her priority will be trade.

Thailand, like other Southeast Asian exporters, can benefit from “reshoring” as multinationals move production out of China to escape Trump’s tariffs. India can also be a winner. But moving entire production lines is neither cheap nor easy. Nor can competitors replicate the sophisticated Chinese supply chain that gets products from inland factories onto those giant container ships bound for Felixstowe.

Chinese spokespeople have struggled with an initial response to the parcel ban. One talked of the “so-called Fentanyl issue,” a crisis which the Chinese commentariat blames on decadence, criminality and lax law enforcement – quite unlike the People’s Republic, it goes without saying. But Trump’s strike against e-commerce, which he clearly sees as a no-lose proposition, must have unsettled Xi and his policymakers. So far, China has responded with calibrated measures against Trump’s decision to impose an additional 15% on duty already charged on imports from China.

It announced a tariff of 15% on coal and liquefied natural gas from the US and similar dues on crude oil, agricultural machinery and large vehicles. In addition, the Chinese government tightened export controls on five strategic metals Tungsten, Tellurium, Bismuth, Molybdenum and Iridium. None of these moves were radical. The tariff levels were not prohibitive and none of the five metals are in critical short supply for US industries. However, the authorities also revived an antitrust probe into Google, whose search engine is banned in China but whose other products, such as its Android OS system, make profits in the country.