A five-week warning has been issued to thousands of Brits who are looking to buy a home ahead of a major tax change next month. According to the latest figures from HMRC, homebuyers paid out £848million in Stamp Duty in January. This is a £40million increase from the same period last year. Stamp duty is a tax that sometimes has to be paid when you buy a property. Whether you need to pay stamp duty depends on the price of the property you’re buying and if you’re a first-time buyer.

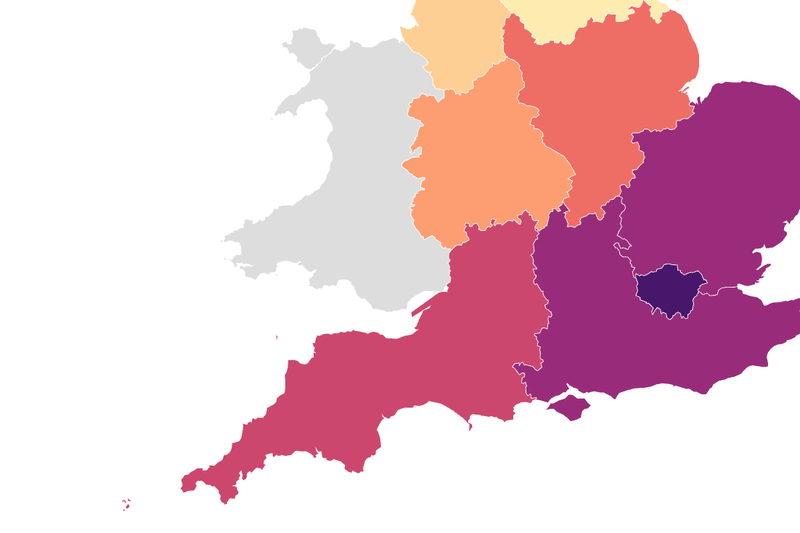

There are also different stamp duty thresholds, which affect how much you may need to pay depending on whether you live in England, Scotland, Wales, or Northern Ireland. The likely reason for the hike in payments is buyers racing to beat the upcoming Stamp Duty tax charges says Coventry Building Society.

Under current rules in England and Northern Ireland, you have to pay stamp duty if your property is your only residence and is worth over £250,000. This higher rate was introduced in September 2022 but is due to go back down to its previous level of £125,000 in March 2025. Coventry Building Society says that buyers now only have a little over 5 weeks until March 31 when the nil-rate threshold drops, which would take the tax bill on an average-priced home in England from around £2,028 to £4,528 - a hike of £2,500.

The threshold for first time buyer relief will also drop from £425,000 to £300,000. According to the high street building society, the average first time buyer home in London sits at £473,282, meaning the Stamp Duty bill for a typical first time buyer will shoot from £2,414 to £8,664. Since the temporary thresholds were announced the Treasury has collected more than £31.3billion in property tax.

According to the January house price index (HPI) from property website Zoopla, demand for homes increased by 13% in January 2025 compared to the same period the previous year. This trend is likely to continue right up until the deadline with thousands of Brits looking to try and beat it.

Jonathan Stinton, Head of Mortgage Relations at Coventry Building Society, said: “Buying a home is about to get a lot more expensive. Those already in the middle of the buying process will be racing against time to beat the deadline. Those who can’t get the keys to their new house in the next five weeks need to brace themselves for a hit which could amount to thousands of pounds.

“Failing to beat the deadline may mean buyers need to eat into their savings to afford the tax hike on their home, or arrange to borrow more on their mortgage to cover the cost. Some buyers may even attempt to renegotiate the selling price so the seller ends up taking the hit, and some potential-buyers may be forced to hold off their purchases altogether.

“The pressure of the deadline will be felt by buyers across the market, with some having to make tough financial decisions in the weeks ahead. But the impact won’t stop on 1st April – higher costs may affect buyer behaviour for months to come. With buyers needing to factor in extra tax we could see a shift in demand, slower sales, and a knock-on effect on house prices.”.

.jpeg?crop=8:5,smart&quality=75&auto=webp&width=960)