According to the high street building society, the average first time buyer home in London sits at £473,282, meaning the Stamp Duty bill for a typical first time buyer will shoot from £2,414 to £8,664.

The likely reason for the hike in payments is buyers racing to beat the upcoming Stamp Duty tax charges says Coventry Building Society.

Coventry Building Society says that buyers now only have a little over 5 weeks until March 31 when the nil-rate threshold drops, which would take the tax bill on an average-priced home in England from around £2,028 to £4,528 - a hike of £2,500.

“Failing to beat the deadline may mean buyers need to eat into their savings to afford the tax hike on their home, or arrange to borrow more on their mortgage to cover the cost.

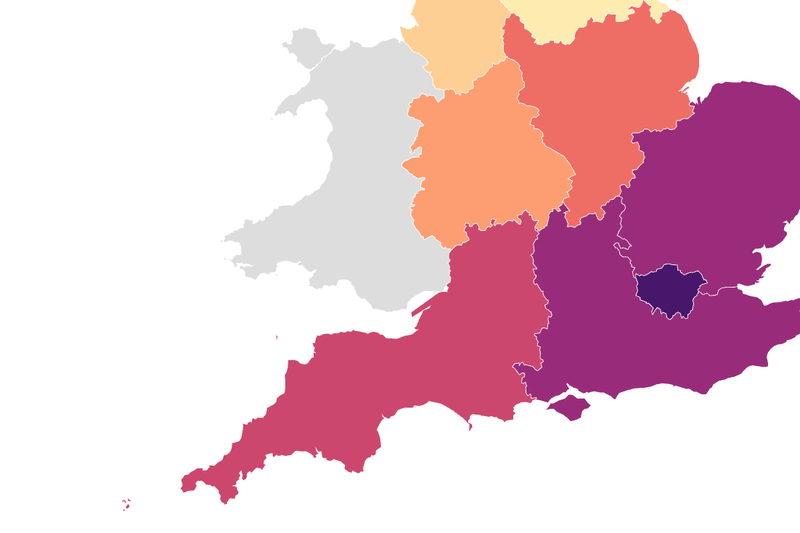

There are also different stamp duty thresholds, which affect how much you may need to pay depending on whether you live in England, Scotland, Wales, or Northern Ireland.

.jpeg?crop=8:5,smart&quality=75&auto=webp&width=960)